I'm a lawyer, so I have a lot of files. There's always new clients coming in, so I keep needing more and more files. Obviously to identify these files, I print labels to stick on them. We use the very nice Avery 5166 Permanent Filing Labels for our files. These are quite nice as they and come on a standard letter-size paper with a template. Often times others have to print a list of labels for envelopes which you can't just print your list directly onto the envelopes. Thanks to the inventi...

As I lay out in my (not) famous weight loss book, calorie control is key to any weight loss program. To accomplish this, I am/was a big fan of MyFitnessPal. It has an easy way to log calories on my phone or the web with a good searchable database, and it used to have a magical barcode scanner. I even got my cheapo smart scale's app to sync with MyFitnessPal through Google Fit so I don't even have to type my weight anymore like some plebeian.

However, it also has some veeerrryyy question...

Landscaping is a good job that many people do either full-time or on the side. However, people aren't always willing to pay you for providing them your services after the work's been done. Many landscapers are small enterprises that may not have a great process to ensure payment and may not know what their rights are under the law.

One idea is the possibility of filing a mechanic's lien. These allow people get a security interest in the property for certain work they do on a property. Typicall...

A moderate tragedy struck my small family recently. My wife began having pain on the left side of her mouth. She found a dentist, and got the problematic cavities fixed, but her teeth still hurt. She tried to be patient, and Sensodyne helped, but she still has pain anytime she eats or drinks anything hot or cold and worse: anytime she drinks coffee.

I wouldn't say she's an addict, but my wife is still a coffee aficionado. She drinks it most days both for sharpness and scrumptiousness. The pain...

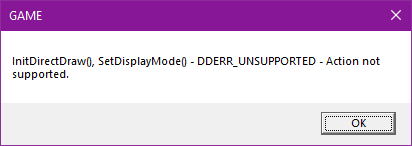

My wife is huge fan of the Nancy Drew games, so since we've been playing through them, which has been quite fun for both of us. However, some of them are rather old at this point, which occasionally causes some problems. I recently bought Nancy Drew: Secret of the Old Clock on Steam. We played it for a few hours Friday night, then went to play it again yesterday, only to be greeted by the following error:

So it says "DirectDraw" in there. That's an old graphic API in Microsoft's DirectX...

Medial Equipment Sale Scam for Attorneys

May 19, 2022

My firm received an interesting email yesterday from a Gmail address:

Hello [name],

I have been contacted by Holy Cross Hospital regarding purchasing our Cardiac Magnetic Resonance Imaging Equipment. We have been negotiating and I have agreed to sell The 2012 used GE Discovery MR450 MRI Equipment to Holy Cross Hospital, 2701 W 68th St, Chicago, IL 60629. We have discussed and agreed on the purchase price and outlined terms for the transaction. I need your legal assistance to help draft a...