As an estate planning attorney, I know that one of the most important things to do as you get older is to give someone you trust power of attorney. Even simple financial tasks can become rather complicated with age (and the limited mobility that comes with it). Typically our elderly clients will name one their kids as their agent to let the child help manage their finances for them. We draft these as broad as possible, so as to not tie the hands of someone trying to help, and they include authority to file tax returns on behalf of the parent. However, the IRS does not make it intuitive how to do this.

The IRS is incredibly picky about what POAs it will accept. To be accepted, a POA must include:

- The taxpayer's name, address, and social security number

- The agent's name and address

- The type of taxes concerned and the form therefor

- The specific years involved (you cannot say "all years", and you can only list years up to three years in the future)

- The taxpayer's dated signature

No state statutory POA complies with this, and I would not advise putting your social security number on your POA anyway. Even if you tried to comply when drafting a POA, it could only work for three years anyway before a new one would have to be signed. Since the goal is to avoid having to do a signing in a nursing home—especially in case the taxpayer may literally not be able to—an alternative is needed.

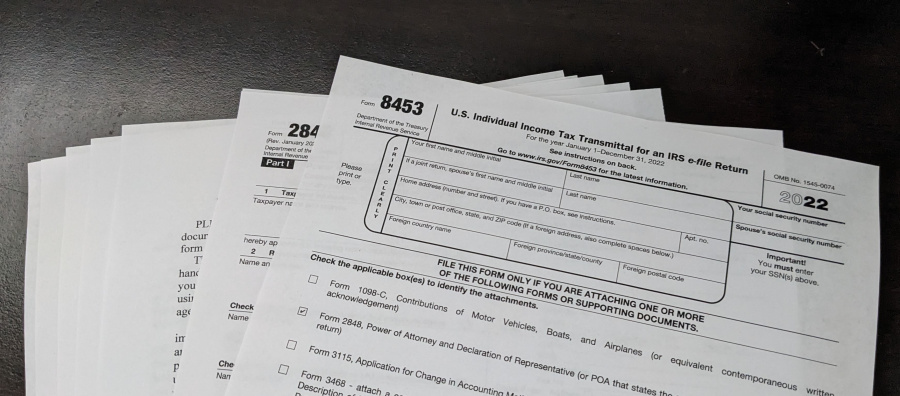

Thankfully, the IRS does have an alternative, but it's one which makes the whole thing very silly. The IRS provides its own power of attorney form, Form 2848, which meets its own rules. This doesn't really help if the taxpayer is not able to sign it, but the IRS actually allows the financial POA to sign its POA form on behalf of the taxpayer. Essentially, the POA can just name themselves POA the IRS way. The IRS calls this "perfecting" the POA.

Frankly, this doesn't make any sense. If the IRS accepts a state POA as valid, why do they need specific years typed in on a separate form? If it doesn't accept state POAs, why can a POA sign the 2848? I don't know, but it's what the IRS wants, so it's what we have to do.

However, this is the 203rd decade, we don't paper file returns. Preparers have to file a special form just to be allowed to paper file. (And you'll be waiting forever for a refund.) Unfortunately, the IRS does not let you e-file POAs. If you are e-filing a tax return, you have to do the following:

- Fill out Form 8453

- Fill out Form 2848, sign it as attorney-in-fact, and attach it

- Attach your state POA

- Sign Form 8879 as attorney-in-fact as normal to allow your ERO to e-file your return

- Within 3 days of the IRS accepting your e-filed return, mail the 8453, 2848, and POA to:

Internal Revenue Service

Attn: Shipping and Receiving, 0254

Receipt and Control Branch

Austin, TX 73344-0254

Of course, the IRS won't know who signed 8879 unless they audit the ERO, but as an ERO it is very important to comply with IRS transmittal requirements to avoid losing that status. Accepting an 8879 signed by an agent requires a 2848 to be filed with the IRS. The above is a bit tricky to figure out, but not hard to comply with.

The above is my understanding of the law. I am a lawyer, but I am not your lawyer. This post does not constitute legal advice. I make no warranty as to its accuracy or applicability to you. If you need a lawyer, get a lawyer. If you want me specifically, hire me.